MEDICARE ABC & D's

What is Medicare and how is it structured?

Medicare is health insurance for individuals age 65+ as well as recipients of Social Security Disability Income for at least 2 years and people who have End Stage Renal Disease. Medicare is administered by the federal government in conjunction with private insurance carriers. Medicare is divided into four parts: A, B, C and D.

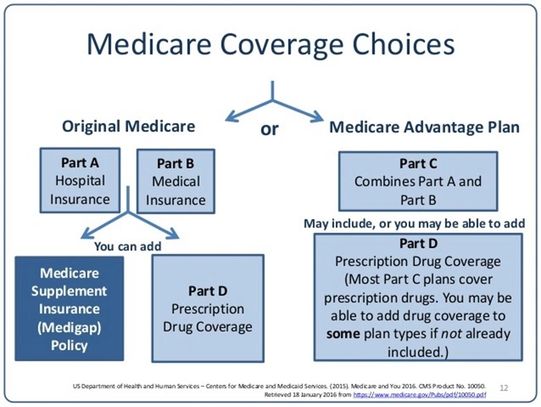

When one begins Medicare, there are two distinct ways to creating your health insurance future:

Either enroll in a Medicare Advantage Plan OR keep Original Medicare.

Medicare Part A: In-Hospital Care

- Part A covers inpatient hospital stays, skilled nursing facility (SNF) stays, limited home health visits, and hospice care due to diagnosis of a terminal illness.

- Part A benefits are subject to a deductible ($1,676 per benefit period in 2025).

- Part A also requires coinsurance for extended inpatient hospital and SNF stays.

- To qualify for SNF stay, one must arrive after an inpatient stay for a minimum of three days. Neither observational status nor the day of discharge count toward the three day requirement.

Medicare Part B: Outpatient Care

- Part B covers medical care, some examples include:

- Physician office visits

- Diagnostic testing - MRI, CT Scans, etc.

- Preventive services -mammography, annual wellness visit, cancer screenings

- Outpatient hospital care and surgery

- Durable medical equipment (wheelchair, oxygen, diabetic supplies)

- Ambulance in life threatening emergency

- Physical, occupational, and speech therapy

- Medication and injections given in the doctor's office/outpatient hospital setting

- Most Part B benefits are subject to a deductible ($257 in 2025) and 20% coinsurance.

Medicare Part C: Medicare Advantage Plans

- Part C is also known as Medicare Advantage (MA) and is a different way to get your Medicare benefits.

- MA plans are network-based health insurance plans provided by private companies that contract with Medicare.

- Beneficiaries enroll in a private health plan, such as a health maintenance organization (HMO) or preferred provider organization (PPO).

- MA plans include all Medicare-covered Part A and Part B benefits and typically also include Part D, prescription drug benefits.

- MA plans may offer coverage for routine vision, dental, hearing, health and wellness programs.

- Referrals and prior-authorization may be necessary, depending on the plan.

- Co-pays and cost sharing is a part of the structure of MA plans, with annual maximum financial out-of-pocket limits.

- There are MA plans specifically created for beneficiaries who are dual-eligible for both Medicare and Medicaid or diagnosed with certain chronic-health conditions.

- And while the MA plan IS your health insurance, you must be enrolled in Part A and Part B, and continue to pay the premium of Part B.

Medicare Part D: Prescription Drug Coverage

- Part D covers outpatient prescription drugs through private plans that contract with Medicare.

- Participation can be through a stand-alone prescription drug plan (PDP) or included within a Medicare Advantage plan (MA-PD).

- The Part D benefit helps pay for enrollees’ drug costs and provides coverage to fill those medications.

- All Part D plans have the same five-tier structure and can have different formulary, list of medications, it will cover.

- Enrollees pay monthly premiums and cost sharing for prescriptions, with costs varying by plan.

- Reviewing your Part D plan should be done on an annual basis, as plan premiums and formularies can change. The Annual Enrollment Period occurs each year between October 15 - December 7.

- Additional financial assistance is available for beneficiaries with low incomes. Contact Social Security to see if you qualify for extra help.

Copyright © 2025 Your Medicare Guru, LLC - All Rights Reserved.

Your Medicare Guru LLC and its affiliates are not connected with or endorsed by any government entity or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov,

1-800-MEDICARE or your local State Health Insurance Program (SHIP) office to get information on all of your options.